How to use your FSA/HSA on Blueair.com

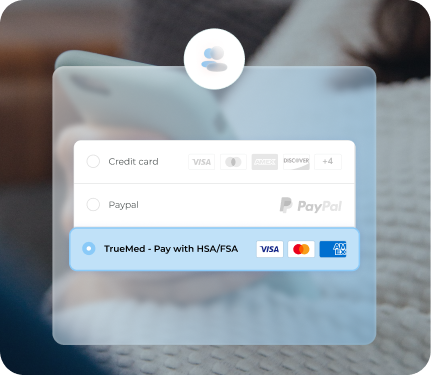

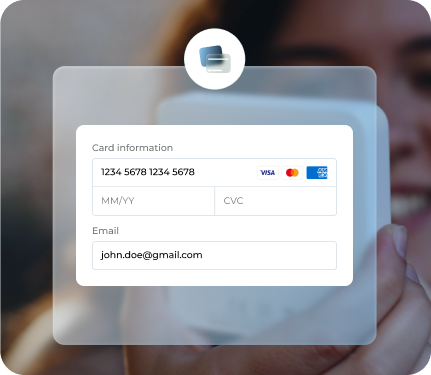

Shop nowQuick & Easy Checkout

Subscription Reimbursement Guide

Common questions

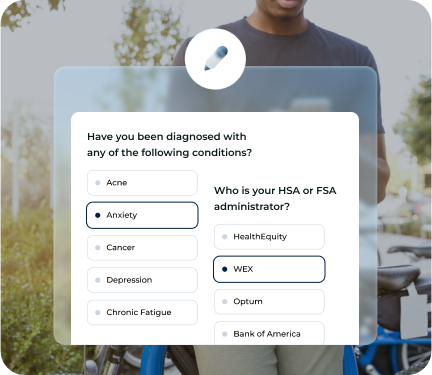

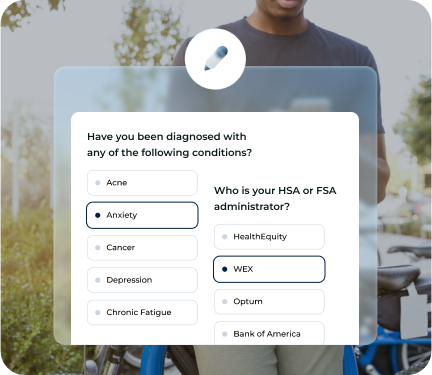

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health. An individual can contribute up to $4,300 pretax to their HSA per year, or $8,550 for a family (plus an additional $1,000 if you are at least 55 years old). Individuals can contribute up to $3,300 pretax to their FSA per year (with an additional $500 in employer contributions allowed). Using pre-tax dollars through your FSA/HSA may provide tax savings, depending on your individual tax situation. For more information on eligible expenses, refer to IRS Publication 502 and IRS Publication 969.